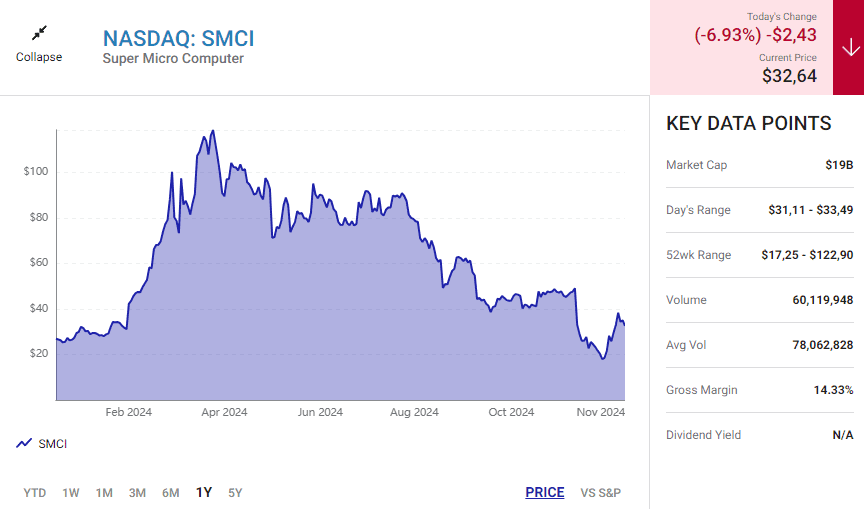

Super Micro Computer (NASDAQ: SMCI) has faced significant challenges recently, raising concerns for potential investors. However, the stock has also shown resilience, leading to renewed interest. If you’re considering adding SMCI to your portfolio, here are three critical factors to evaluate.

1. The New Auditor Raises Questions

Supermicro’s appointment of BDO USA as its new auditor was initially a positive development. Yet, BDO has its own checkered history, raising potential red flags. For example:

- Regulatory Challenges: In 2022, BDO was fined $2 million for errors in a 2018 audit.

- Audit Quality Issues: The Public Company Accounting Oversight Board (PCAOB) found deficiencies in 54% of BDO’s audits in 2020 and 53% in 2021.

Although BDO has taken steps to enhance audit quality, the history of regulatory scrutiny may create skepticism. Additionally, Ernst & Young’s (EY) earlier resignation as Supermicro’s auditor—citing distrust in management’s financial statements—lingers as a significant concern.

2. Compliance Issues with the Nasdaq

Supermicro remains out of compliance with Nasdaq listing requirements. While the company has submitted a compliance plan, it received another notice from Nasdaq on Nov. 20 about ongoing noncompliance.

Key updates:

- Nasdaq Deadline: Supermicro narrowly avoided delisting by submitting its compliance plan.

- Governance Delays: The Independent Special Committee’s promised governance improvement report, due Nov. 15, remains pending.

Until these filings and governance reforms are addressed, investor confidence may remain shaky.

3. Potential for Financial Restatements

The allegations from Hindenburg Research continue to loom over Supermicro. These include accusations of:

- Channel stuffing: Inflating revenue by shipping products that are not yet sold.

- Accounting irregularities: Recognizing incomplete sales and bypassing internal controls.

- Related-party conflicts: Undisclosed transactions between related entities.

The resignation of EY as Supermicro’s auditor highlights the gravity of these concerns. While Supermicro’s products, including its partnerships with Nvidia, validate its operational relevance, unresolved financial discrepancies make the stock speculative.

What’s Next for Supermicro?

Despite these challenges, Supermicro’s recent moves—like hiring a new auditor and regaining partial investor trust—indicate potential for recovery. The stock has surged 92% since its Nov. 15 low, showcasing its volatility and appeal to risk-tolerant traders.

However, for long-term investors, uncertainty around financial restatements and compliance issues makes SMCI a high-risk bet. Clarity on governance and accounting reforms is essential before considering it a viable long-term investment.

Investor Takeaway

While Supermicro offers potential upside, its unresolved financial issues and compliance risks make it unsuitable for conservative or long-term investors at this stage. For those seeking safer alternatives, Stock Advisor’s curated list of high-performing stocks might be a better choice. Supermicro remains a story to watch, but it’s far from a buy-and-hold investment.

Key Metrics Snapshot (as of Nov. 30, 2024):

- 52-week range: $17.25 – $52.23

- Current price: $33.08

- Market cap: $1.75 billion

- Compliance status: Out of Nasdaq compliance