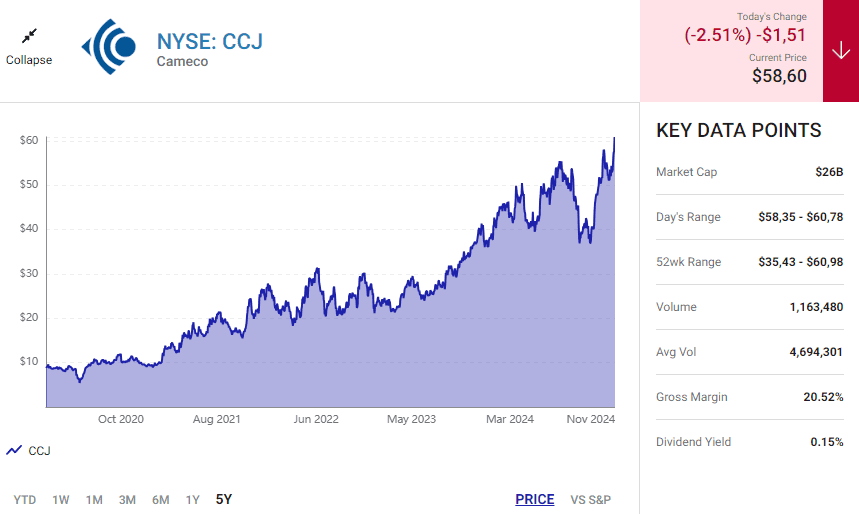

Nuclear power is making a strong comeback. As 31 nations commit to tripling their nuclear energy capacity by 2050, financial institutions like Bank of America, Citigroup, and Goldman Sachs are backing this shift. Amid rising energy demand, Cameco (CCJ), a leading uranium producer, is positioned to benefit as nuclear energy takes a more prominent role in the clean energy future.

Nuclear Power’s Growing Role in Clean Energy

In recent years, the demand for energy has surged, particularly due to the rise of artificial intelligence (AI) and expanding data center needs. Goldman Sachs forecasts a 160% increase in data center power demand by 2030, leading tech companies to look to nuclear energy for a reliable power source.

In a significant move, Microsoft signed a 20-year power purchase agreement with Constellation Energy, which includes restarting the Three Mile Island Unit 1. Oracle is also exploring innovative small modular reactors (SMRs) for data centers, signaling a shift in energy infrastructure. This momentum is further supported by the recent passage of the ADVANCE Act, which encourages nuclear technology innovation by reducing regulatory costs and providing financial incentives.

Cameco’s Strong Position in the Uranium Market

Cameco is one of the largest publicly traded uranium producers, with operations in Saskatchewan, the U.S., and Kazakhstan. The company has a 40% stake in a joint venture with Kazatomprom in Kazakhstan and holds a 49% stake in Westinghouse, a leader in the nuclear services industry. With mines in Saskatchewan and one of the largest commercial refineries in Ontario, Cameco is well-positioned to meet growing demand as uranium supply tightens.

Risks to Consider in Uranium Investments

Uranium prices are influenced by market dynamics and public perception of nuclear energy. Negative sentiment, like the aftermath of the Fukushima disaster, can lead to price declines, as seen from 2011 to recent years. However, with the global push for clean energy, uranium prices are expected to rise, benefiting Cameco in the long term.

Long-Term Trends Favor Cameco

The International Atomic Energy Agency (IAEA) recently revised its projections for nuclear power expansion, forecasting a 2.5x increase in nuclear capacity by 2050. Short-term trends are also promising, with efforts to extend the life of existing reactors and reactivate retired facilities. Uranium prices are forecasted to rise to $110 per pound in the coming year, driven by increasing demand and limited supply, which bodes well for Cameco’s growth.

Conclusion: A Solid Investment Opportunity

Despite the risks associated with commodity-based companies, Cameco’s long-term growth potential in the nuclear energy sector remains strong. With global nuclear capacity on the rise and uranium prices expected to increase, Cameco could thrive in the evolving energy landscape, making it a potentially valuable investment for those looking to capitalize on the resurgence of nuclear power.

Understanding Cameco’s Position in the Stock Market

Cameco Corporation, a leading player in the uranium industry, has captured the attention of investors as nuclear energy makes a comeback. The stock market is showing increased interest in renewable and alternative energy sources, and nuclear power is now considered a crucial player in achieving energy sustainability. This resurgence raises an important question: is Cameco stock a good investment right now?

The Benefits of Nuclear Energy

Nuclear energy provides a low-carbon power solution, making it an attractive option amid growing climate change concerns. With many countries aiming to reduce their reliance on fossil fuels, nuclear energy is expected to play a significant role in future energy strategies. As a result, companies like Cameco, which supply uranium for nuclear power plants, could see increased demand for their products. This could positively impact Cameco’s stock performance as global interest in nuclear energy rises.

Evaluating Cameco Stock for Investment

When considering Cameco stock as an investment, it’s essential to analyze its recent performance, market trends, and future projections. Recent reports indicate a bullish sentiment surrounding uranium prices, which directly influences Cameco’s profitability. If trends continue, this might create a favorable environment for investors. However, potential investors should also consider market volatility and the company’s financial health before making any decisions.

In conclusion, while the prospects for Cameco stock are tied to the broader market movements of nuclear energy, careful evaluation and consideration of market dynamics will help determine its suitability for your investment portfolio.