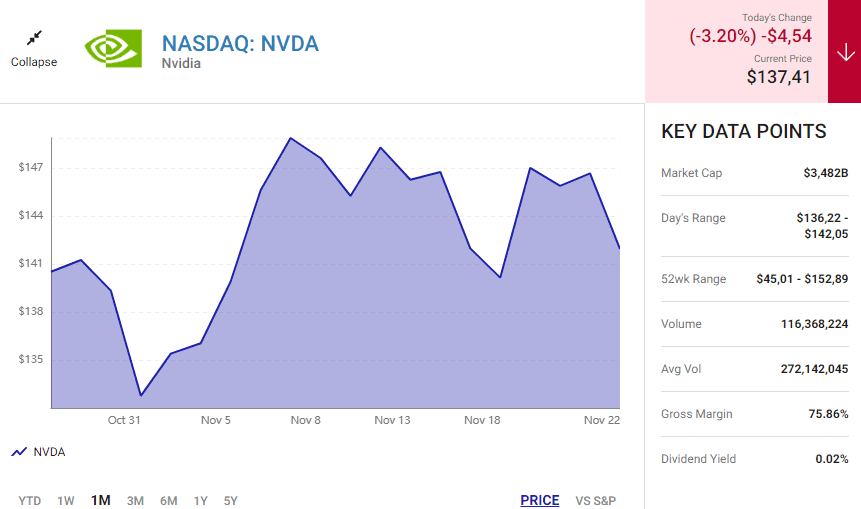

Nvidia’s (NVDA) stock dropped by 3.4% following its fiscal 2025 third-quarter results, but many investors see this as an opportunity to buy. Despite slower revenue growth projections for 2026, Nvidia’s dominance in artificial intelligence (AI) keeps it a strong long-term investment.

Slower Growth, But Strong Fundamentals

Analysts predict that Nvidia’s revenue growth will slow from 111.9% in fiscal 2025 to 49.2% in fiscal 2026. However, the company’s fundamentals remain strong, particularly in the booming AI sector. Nvidia holds an 80% market share in AI chips, positioning it as a key player in the growing AI infrastructure market.

Record Revenues and AI Demand

Nvidia’s fiscal 2025 third-quarter earnings showed a record $30.8 billion in data center revenue, a 112% year-over-year increase. This growth is driven by strong demand from cloud giants like Microsoft, Alphabet, and Amazon, who are heavily investing in AI infrastructure. These companies plan to spend a combined $267 billion on AI investments in 2024 alone.

Market Expansion and Technological Innovation

Nvidia is also benefiting from its cutting-edge technology. The company’s H200 chip and Blackwell platform are gaining traction, with major cloud providers like AWS and Microsoft Azure incorporating them into their AI operations. Nvidia’s innovations are driving both sales growth and demand for its products, contributing to its market dominance.

Why Nvidia’s Valuation Still Makes Sense

While Nvidia trades at a premium with a forward earnings multiple of 33.6, its growth trajectory justifies the higher valuation. The company’s gross margin of 74.6% reflects exceptional operational efficiency, even as it scales production to meet increasing AI demand.

Long-Term Potential in AI and Beyond

Despite a slowdown in growth, Nvidia’s long-term potential remains strong. As AI infrastructure continues to expand, Nvidia is poised to benefit from the next wave of AI breakthroughs. CEO Jensen Huang believes the industry is nearing a “Gutenberg moment,” with the potential for artificial general intelligence (AGI) in the next few years—something that would require immense computational power, positioning Nvidia at the center of this shift.

For many investors, Nvidia’s market position, technological innovation, and dominance in AI make it a compelling long-term investment, even in the face of slowing short-term growth. This dip in stock price presents a prime opportunity to add to positions in this AI powerhouse.