Cathie Wood, the daring CEO and CIO of Ark Invest, is well-known for her aggressive growth investing strategy. Her ability to spot market-shaping trends has earned her both fame and scrutiny. On Monday, she added to her stakes in Amazon, Ibotta, and Teradyne, three companies in different stages of growth and transformation. Let’s dive into why these stocks made her list and explore broader investment trends that could shape the market in 2025.

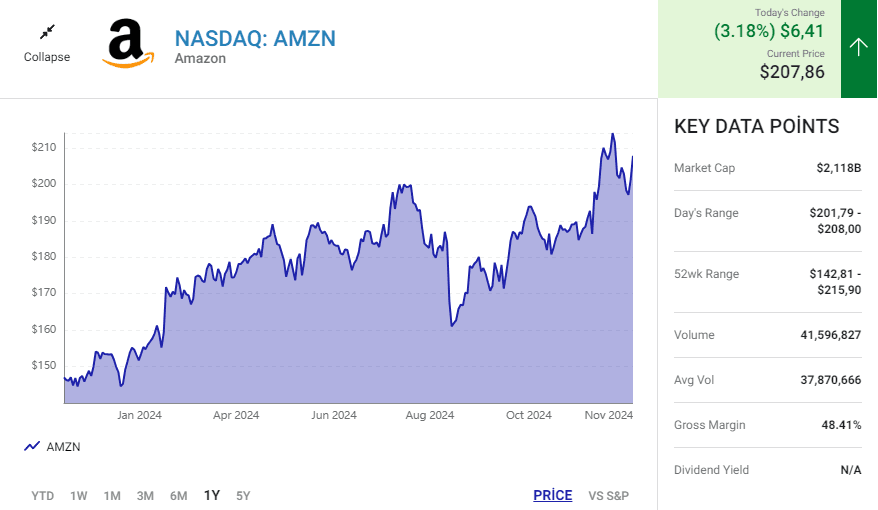

1. Amazon: Reinventing Itself Yet Again

Amazon, already a titan in e-commerce and cloud computing, is proving that even giants can evolve. Its recent $4 billion investment in Anthropic—a rising star in AI—positions Amazon Web Services (AWS) as a major player in artificial intelligence. AWS Trainium will become the backbone for Anthropic’s largest models, which could help Amazon shift from an AI underdog to a leader.

However, Amazon isn’t without its challenges. Its supply chain heavily depends on Chinese imports, exposing it to potential tariff risks in 2025 if U.S.-China trade tensions escalate. The launch of its budget-friendly shopping platform, Haul, has drawn comparisons to fast-growing competitors like Shein and Temu, but questions remain about sustainability given its reliance on low-cost sourcing.

Despite these hurdles, Amazon’s decision to freeze seller fees for 2025 shows its focus on long-term relationships over short-term gains. With its stock up 33% in 2024, investors continue to trust Amazon’s ability to navigate market shifts and stay ahead of the curve.

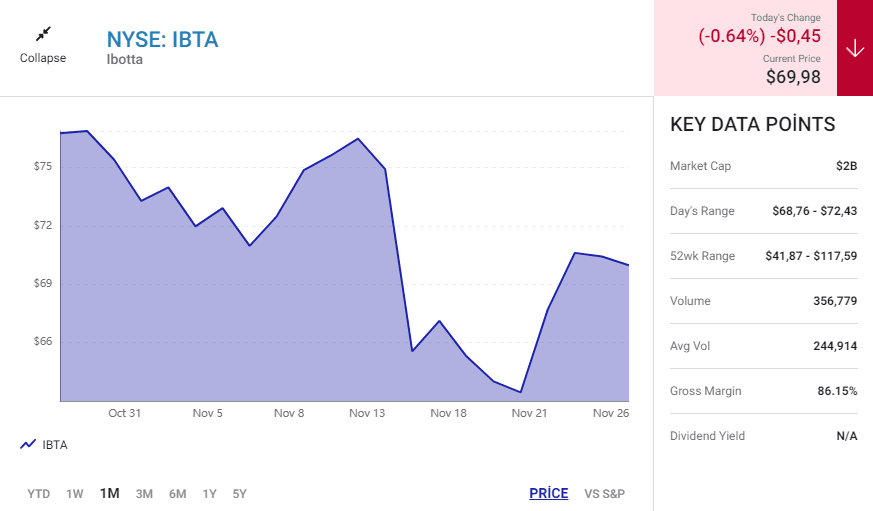

2. Ibotta: A Hidden Gem or a Troubled Start-Up?

Ibotta, a rewards platform that connects shoppers with brands, initially struggled to impress Wall Street after its IPO. Revenue growth slowed significantly in 2024, raising concerns about its scalability. However, the company still boasts over 15 million active users, signaling untapped potential.

What makes Ibotta intriguing is its resilience in any economic environment. As consumers look for savings during tighter economic conditions, platforms like Ibotta can thrive. Its “pay-for-performance” advertising model is particularly appealing to brands seeking ROI-focused campaigns in 2025. Yet, for Ibotta to truly shine, it needs to regain its growth momentum—something Cathie Wood seems optimistic about.

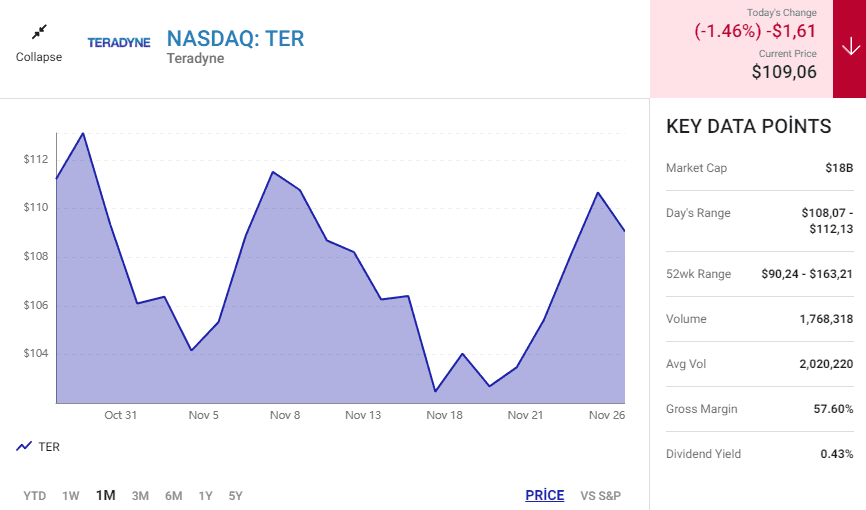

3. Teradyne: Rebounding from a Slump

Teradyne, a leader in semiconductor testing equipment, has faced challenges with declining revenues in recent years. However, recent quarters have shown a return to growth, as global demand for chips surges. With a renewed $2 billion share buyback program, Teradyne signals confidence in its recovery.

The semiconductor industry is expected to grow significantly in 2025, driven by advancements in AI, 5G, and automotive technologies. Cathie Wood’s increased stake suggests she sees Teradyne as a key beneficiary of these trends.

What Could 2025 Hold for Growth Investors?

Cathie Wood’s stock picks align with broader trends expected to shape the market in 2025:

- AI Integration Across Industries: From Amazon’s AI initiatives to chipmakers like Teradyne, artificial intelligence will remain a driving force. Companies investing heavily in AI could see exponential growth.

- Consumer-Focused Tech: Platforms like Ibotta, which cater to cost-conscious consumers, are poised to benefit from increased adoption of digital rewards and loyalty programs.

- Sustainable Growth in Tech: Despite high valuations, tech companies that address long-term challenges (e.g., climate change, automation) are likely to remain attractive to investors.

Final Thoughts

Cathie Wood continues to make bold, calculated moves in the market, focusing on companies that reflect her vision of innovation and disruption. Whether you’re an aggressive growth investor like Wood or prefer a more cautious approach, the underlying trends in AI, semiconductors, and consumer tech are hard to ignore.

While her Ark Invest funds have faced volatility, her commitment to staying ahead of the curve offers valuable insights for investors. Are these stocks right for you? That depends on your appetite for risk and your faith in the transformative power of technology in 2025 and beyond.