As we enter the final month of 2024, savvy investors have a golden opportunity to capitalize on market trends before the year ends. With the AI revolution accelerating and key players dominating their niches, December presents a chance to add three promising stocks to your portfolio: ASML Holding (ASML), Taiwan Semiconductor Manufacturing Company (TSMC), and Meta Platforms (META). These companies are not just market leaders but are well-positioned to thrive in the burgeoning AI and semiconductor industries. Let’s dive into why these stocks are worth considering.

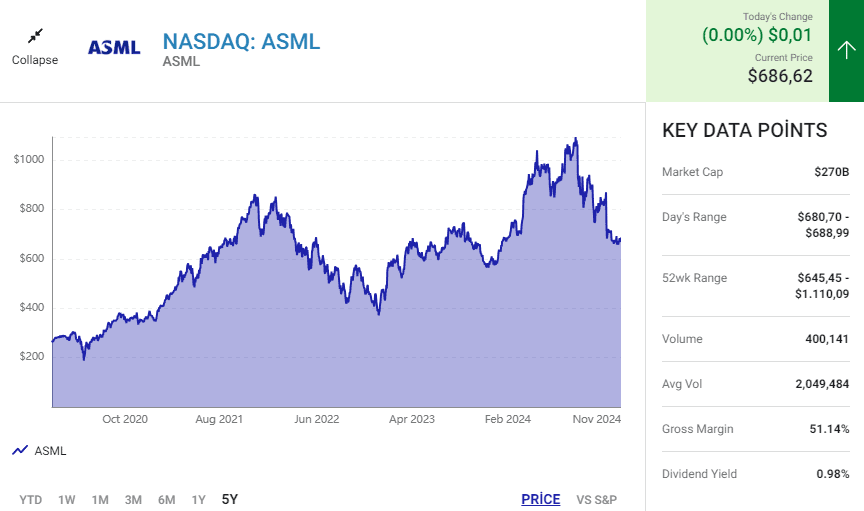

1. ASML Holding (ASML): The Backbone of Semiconductor Innovation

Why ASML Is Essential

ASML’s lithography machines are crucial for manufacturing the most advanced chips in the world, with features as small as 3 nanometers. As the sole producer of these machines, ASML holds a technological monopoly, ensuring strong long-term demand for its products.

Current Challenges and Opportunities

While ASML has faced challenges like export restrictions to China and reduced 2025 revenue guidance, these setbacks have created a buying opportunity. The stock currently trades at 33 times forward earnings, offering a chance to invest in a market leader at a fair valuation. As global semiconductor demand continues to grow, ASML’s dominance is unlikely to be challenged, making it a compelling long-term investment.

Key Question: Is ASML Overpriced?

Given its unique position in the semiconductor supply chain and the significant capital required to compete in this space, ASML’s current valuation reflects its future potential. For investors with a long-term horizon, the stock’s recent dip offers an attractive entry point.

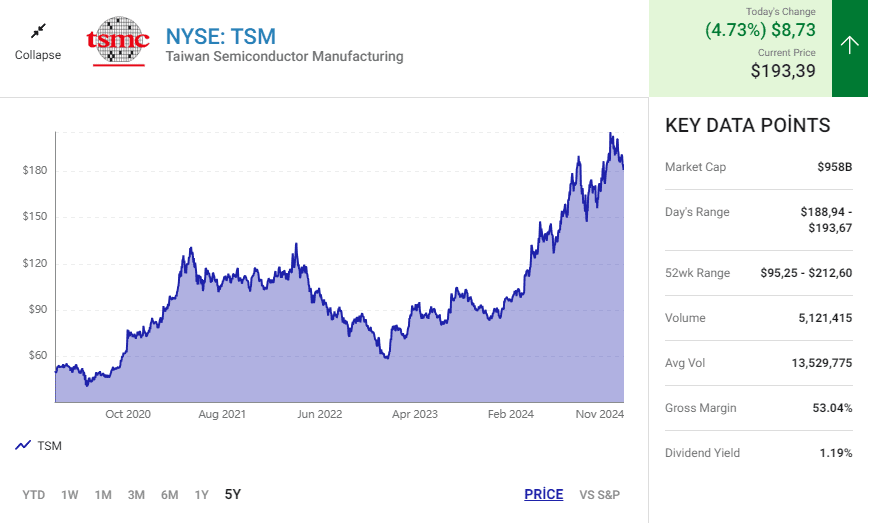

2. Taiwan Semiconductor Manufacturing Company (TSMC): Powering the AI Era

Why TSMC Is a Game Changer

TSMC is the manufacturing partner for industry giants like Nvidia and Apple, producing cutting-edge chips that power everything from AI applications to smartphones. The company is already producing 3nm chips and is working on 2nm technology, ensuring it stays ahead of the competition.

Growth Prospects

Wall Street projects 25% revenue growth and a 26% increase in EPS for TSMC in 2025. This steady growth trajectory makes it an attractive option for December buyers. While the stock is no longer “cheap,” it is reasonably valued, reflecting the company’s strong fundamentals and growth potential.

Frequently Asked Question: Can TSMC Maintain Its Leadership?

TSMC’s focus on innovation and its strategic partnerships with leading tech companies position it to maintain its leadership in the semiconductor industry. Its ability to deliver cutting-edge technology consistently makes it a safe bet for investors.

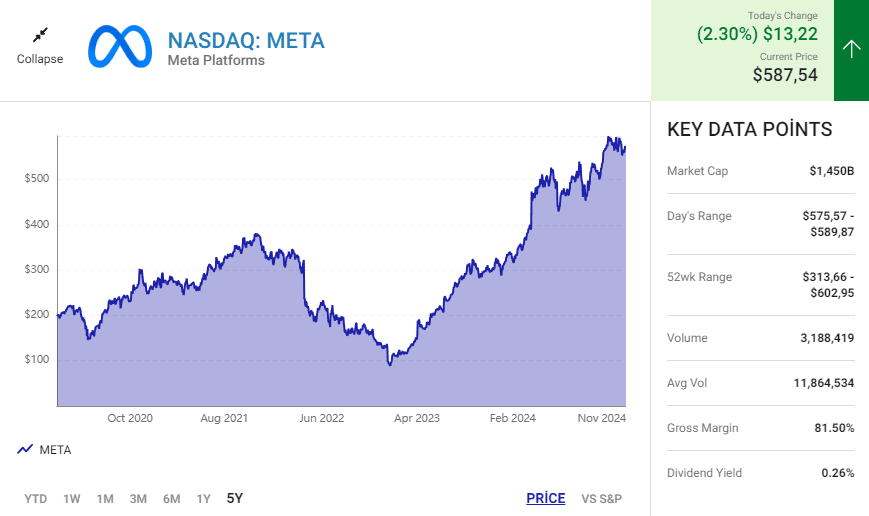

3. Meta Platforms (META): The Future of Generative AI

Why Meta Stands Out

Meta Platforms is leveraging its expertise in AI to revolutionize the tech landscape. Its open-source Llama AI model has become a preferred choice for developers, offering transparency and flexibility. This positions Meta as a leader in the generative AI space.

Financial Strength

Meta trades at 25.4 times forward earnings, which is only slightly above the S&P 500’s average of 23.5 times. Considering its recent quarterly performance, with revenue up 19% and EPS soaring by 38%, the stock is attractively priced.

Common Investor Query: Is Meta Overreliant on Ads?

While ads remain a significant revenue source, Meta’s investment in AI, the metaverse, and other innovative technologies diversifies its revenue streams. The Llama model’s potential to drive AI development further strengthens its growth story.

Why December Is the Time to Buy

All three stocks—ASML, TSMC, and Meta—offer unique opportunities to capitalize on emerging trends in AI and semiconductors. Here’s why each is a smart buy:

- ASML: Undervalued after recent setbacks but essential for global chip production.

- TSMC: A steady growth story with unmatched capabilities in chip fabrication.

- Meta: A leader in AI innovation with strong financial performance.

Pro Tip for Investors

While these stocks are strong contenders, diversifying your portfolio and considering your risk tolerance is essential. These companies thrive in tech-heavy sectors, which can be volatile in the short term but rewarding in the long run.

Should You Invest $1,000 in These Stocks?

Before making a decision, consider your investment goals and time horizon. Each of these stocks offers substantial growth potential but comes with its risks. Perform due diligence, keep an eye on market trends, and consider consulting with a financial advisor to align your investments with your financial objectives.

Your Takeaway

December is not just about holiday cheer—it’s a month for smart investment moves. By adding ASML, TSMC, and Meta to your portfolio, you’re positioning yourself to benefit from the next wave of technological advancements. As always, patience and strategic planning are key to long-term success.