Overview of the Fintech Landscape

The fintech industry has undergone rapid transformation over the past decade, making significant strides in redefining the way financial services are delivered and consumed. Financial technology, or fintech, leverages modern innovations to enhance or automate financial services, resulting in improved efficiency and accessibility for consumers and businesses alike. As we approach 2025, several key trends are shaping the fintech landscape, warranting careful attention from stakeholders.

One of the most notable trends is the rise of digital banking services. Traditional banking institutions are increasingly challenged by agile fintech startups that offer streamlined, user-centric services through innovative platforms. These startups utilize advanced technologies such as artificial intelligence (AI) and machine learning to deliver tailored products, create personalized customer experiences, and facilitate faster decision-making processes. In contrast, established financial institutions are investing heavily in digital transformation initiatives to remain competitive while navigating regulatory landscapes and legacy system constraints.

Moreover, the advent of blockchain technology and cryptocurrencies has ushered in newfound transparency, security, and efficiency within the sector. Blockchain’s decentralized nature not only minimizes fraud but also improves transaction speed and reduces costs. Consequently, established financial institutions are exploring blockchain solutions not only to innovate their services but also to comply with evolving regulatory frameworks.

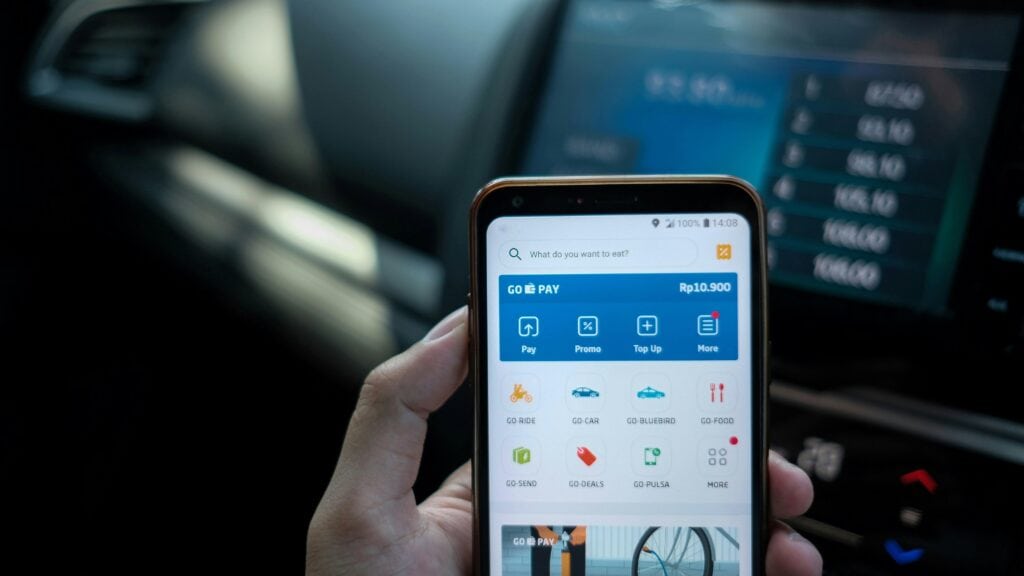

Shifting consumer expectations also play a significant role in this evolving landscape. As consumers demand enhanced convenience and personalized experiences, fintech companies are pivoting to meet these expectations through the use of mobile applications and user-friendly interfaces. Consequently, innovation has become paramount, with no signs of slowing down. To navigate this complex yet exciting environment, understanding the dynamics between emerging technologies and traditional financial service models will be critical as we look towards a fintech-driven future.

Key Emerging Technologies in Fintech

The fintech sector is rapidly evolving, primarily driven by cutting-edge technologies that hold promise for the future. As we look ahead to 2025, several key emerging technologies are poised to transform financial services, reshaping customer interactions and operational processes.

Artificial intelligence (AI) and machine learning are at the forefront of this technological revolution. These tools enable personalized banking solutions that enhance the customer experience. Financial institutions can analyze vast amounts of data to create tailored products, identify customer preferences, and predict spending behaviors. This capacity for personalization not only improves client satisfaction but also boosts customer retention, as clients find value in services that are intricately designed to meet their needs.

Blockchain technology is another significant innovation within fintech. Its decentralized nature offers a secure method for conducting transactions and executing smart contracts. By removing intermediaries, blockchain reduces the potential for fraud and enhances transaction speed. Furthermore, its capability for creating transparent records can be particularly beneficial in sectors such as supply chain finance and remittances. Organizations leveraging blockchain could expect greater trust and efficiency in their operations.

Robotic process automation (RPA) is also gaining traction, promoting efficiency by streamlining routine operational tasks. By automating transactional processes, financial institutions can reduce human error and free up valuable manpower for more strategic roles. RPA can lead to cost savings and operational agility, directly impacting the bottom line and service delivery.

Meanwhile, quantum computing presents a new frontier for advanced risk analysis and trading strategies. Although still in nascent stages, its potential for processing complex algorithms at unimaginable speeds could revolutionize decision-making in financial markets. These emerging technologies collectively indicate a future where fintech is not only more efficient but also increasingly secure and customer-centric.

Regulatory Challenges and Opportunities

The emergence of fintech has revolutionized the financial landscape, leading to significant transformations in how financial services are delivered. However, this rapid advancement poses regulatory challenges that must be addressed to ensure a secure operating environment for both companies and consumers. As technologies evolve, regulatory frameworks are tasked with adapting to innovations that could challenge existing norms. This necessity to keep pace with new developments generates an array of regulatory dilemmas, primarily focusing on balancing innovation with adequate consumer protection.

One of the pivotal aspects of regulation in the fintech space is the establishment of guidelines that support the growth of technologies while safeguarding consumer interests. Regulation should facilitate innovation rather than stifle it, leading to greater collaboration between fintech firms and regulatory authorities. There is an increasing recognition of the need for regulatory bodies to engage in dialogue with fintech companies. This can result in the creation of a regulatory sandbox, where startups can test their products under a controlled regulatory framework, ultimately fostering innovation while ensuring compliance and consumer protection.

Moreover, compliance remains a critical element for maintaining trust and integrity within the financial system. A robust regulatory environment ensures that fintech companies adhere to ethical standards, thereby protecting consumers from fraud and exploitation. Collaboration between fintech entities and regulators can also lead to the development of shared data platforms that enhance compliance monitoring and risk management, which can optimize operational efficacy for both parties.

In conclusion, while challenges are abundant within the regulatory landscape of fintech, there exists a unique opportunity for growth. The future hinges on creating regulatory frameworks that not only address potential risks but also promote innovation, fostering a cooperative partnership between fintech firms and regulatory bodies. This balance is vital to harnessing the full potential of emerging technologies in the financial sector.

The Path Forward: Predictions for 2025

As we look ahead to 2025, the fintech landscape is poised for transformative changes driven by a range of emerging technologies. Consumers are increasingly adopting digital banking solutions, leading to a paradigm shift in how financial services are delivered. A growing emphasis on user experience and personalization is expected to reshape consumer behavior, prompting banks and fintech firms to refine their offerings to meet evolving expectations.

Decentralized finance (DeFi) is anticipated to gain significant traction, providing consumers with alternatives to traditional banking services. This movement toward decentralized platforms promises enhanced accessibility, reduced reliance on intermediaries, and greater user autonomy over financial assets. As DeFi continues to develop, traditional financial institutions will need to adapt swiftly to this trend, as competition from decentralized platforms poses a considerable threat to their market share.

In addition, advancements in artificial intelligence (AI) and machine learning will revolutionize risk assessment and fraud prevention, allowing businesses to enhance security while simultaneously optimizing operational efficiency. Financial institutions that harness these technologies can expect not only to mitigate risks but also to tailor products that align precisely with consumer needs and preferences.

To remain competitive in this rapidly evolving ecosystem, businesses must adopt innovative strategies that embrace digital transformation. Collaboration among fintech startups and traditional institutions is likely to become the norm, fostering an environment conducive to innovation and agility. Furthermore, upskilling employees to tackle new technologies will ensure that organizations are equipped to handle the shifting dynamics in finance.

In conclusion, the future of fintech in 2025 will be marked by evolving consumer expectations, the rise of DeFi, and advancements in technology that necessitate a proactive approach from businesses. By staying ahead of these trends, companies can navigate the challenges and seize the opportunities presented in a digitally-driven financial landscape.