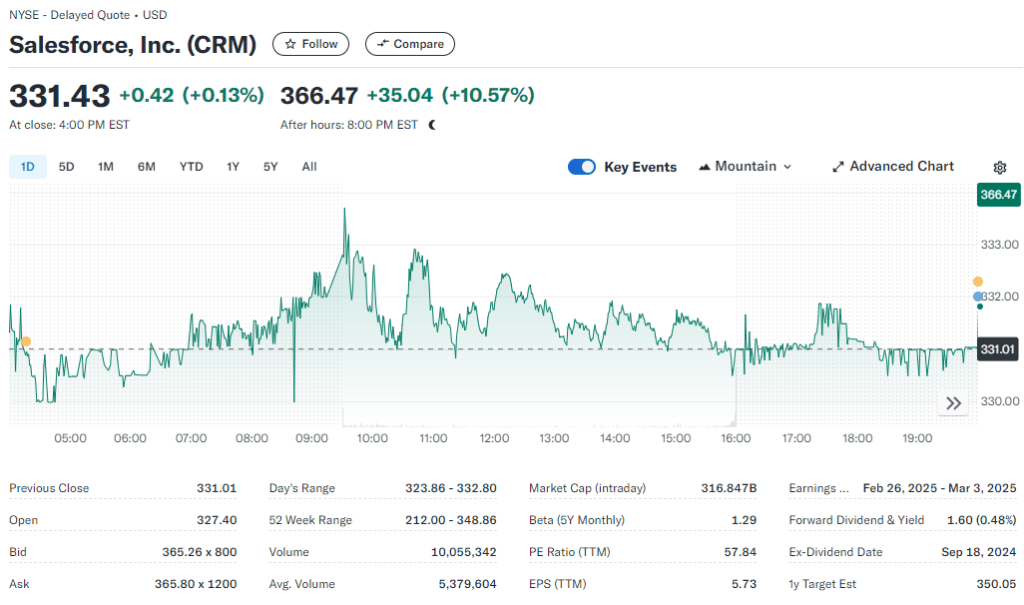

Salesforce Inc.’s significant investment in artificial intelligence (AI) has propelled its shares to an all-time high. Now, Wall Street is eager to see if the hefty spending on AI initiatives will deliver the promised returns.

The customer relationship management (CRM) software leader is set to report its latest financial results, with analysts closely watching for any updates on its AI-related endeavors. Salesforce’s flagship AI tool, Agentforce, launched in October, has been a focal point. This generative AI product can automate tasks such as customer support without human intervention. Salesforce has also been on a hiring spree to bolster its AI initiatives and recently acquired Tenyx, a company specializing in AI-powered voice agents.

Salesforce CRM Stock Surges Amid AI Innovations and Market Optimism

Salesforce CRM stock has been at the center of attention, driven by its innovative AI tools like Agentforce. With shares reaching record highs, the company showcases its strong potential in leveraging AI for customer relationship management. This marks a critical shift in how AI-powered solutions are transforming business operations and financial markets. As Salesforce continues its AI evolution, its stock performance is poised to remain a key focus for investors.

Optimism Meets Skepticism

Citi analyst Tyler Radke noted that Agentforce has dominated Salesforce’s narrative, receiving positive but early feedback from partners. However, he cautioned that this quarter’s results might serve as a “reality check” after the stock’s approximately 30% climb since the Dreamforce event in September. Despite this, Salesforce shares dipped 0.4% on Tuesday.

While AI has been a significant driver of Wall Street’s rally for nearly two years, much of the revenue growth has been concentrated in chipmakers like Nvidia and cloud giants like Microsoft. Investors now anticipate software companies like Salesforce to be the next big beneficiaries of AI innovation.

Eric Clark, portfolio manager at Rational Dynamic Brands Fund, emphasized the transformative potential of Salesforce’s AI tools. He projected that adoption rates for these tools will impress the market over the next three years. Despite the optimism, Clark acknowledged that the rollout might face initial hurdles and suggested investors view any stock volatility as a buying opportunity.

A Crucial Quarter Ahead

Salesforce’s third-quarter results follow a turbulent year for the company. Shares plummeted in May after weak sales growth forecasts raised concerns about its AI strategy. However, the stock has since rebounded, climbing over 50%. The rebound was bolstered by cost-cutting measures and a better-than-expected outlook in recent results.

Despite the recovery, analysts have been hesitant to significantly revise their estimates. According to Bloomberg data, forecasts for 2025 earnings and revenue have remained largely flat, even as Salesforce has emphasized its new AI offerings. This discrepancy has pushed Salesforce’s valuation higher, with the stock trading at about 30 times estimated forward earnings, compared to an all-time low of 21 in May.

High Expectations for AI

Feedback for Agentforce has been overwhelmingly positive, with JPMorgan analysts reporting that it scored among the highest of any Salesforce product in their recent survey. However, Mark Murphy of JPMorgan warned that while Agentforce is a critical innovation, it is unlikely to substantially impact revenue growth for at least a year.

“Excitement for AI products often leads to volatility around earnings reports,” Murphy noted, suggesting that expectations for this quarter may be overly ambitious.

Broader Tech Trends

Meanwhile, the tech sector is experiencing significant shifts:

- SpaceX is reportedly discussing an insider share sale that could value the company at $350 billion.

- The sudden resignation of Intel CEO Pat Gelsinger opens the door to potential deals previously dismissed under his leadership.

- The U.S. has introduced new restrictions on China’s access to chipmaking and AI components, intensifying competition in the tech space.

Earnings in Focus

Several other tech companies, including Marvell Technology, Pure Storage, Okta, and Box, are also set to report their earnings, making this a critical week for investors closely monitoring the sector.