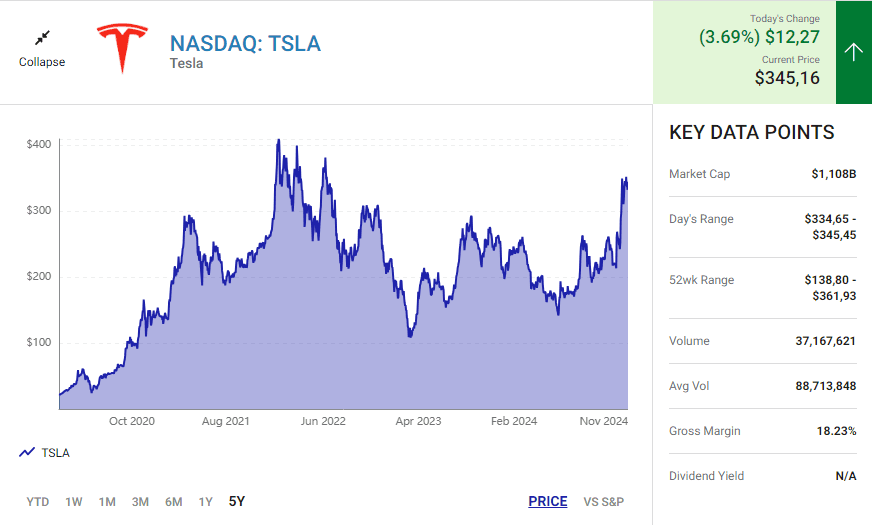

Tesla (NASDAQ: TSLA) shares have been gaining momentum recently. Following the release of its third-quarter earnings on Oct. 23, the electric vehicle (EV) giant’s stock surged by 62% as of Nov. 25. A post-election market rally also contributed to the upward trend.

However, Tesla’s stock price still sits 15% below its peak from three years ago. With this recent uptick, potential investors might be wondering if now is the right time to buy into Tesla. Let’s dive deeper into the key factors shaping Tesla’s future.

Slowing Growth Poses Challenges

Tesla revolutionized the auto industry with its sleek, high-tech EVs, earning a market valuation of $1.1 trillion. While the company has long been synonymous with rapid growth, recent trends show a deceleration.

In the third quarter, Tesla reported $20 billion in automotive revenue—a mere 2% year-over-year increase and 6% lower than Q4 2022. The company’s growth trajectory is no longer as robust as it once was.

Several factors are impacting Tesla’s sales. Rising interest rates have made financing a new vehicle less affordable, especially for Tesla’s premium-priced models. Additionally, Tesla faces intensifying competition. In the U.S., legacy automakers like Ford and General Motors are ramping up their EV offerings. Internationally, Chinese automakers are giving Tesla stiff competition, particularly in the world’s largest EV market.

Analysts project Tesla’s revenue will grow at a compound annual rate of 12.4% between 2023 and 2026. While respectable, this marks a significant slowdown compared to the company’s historic performance.

Autonomous Driving: The Future or a Gamble?

Today, Tesla’s revenue relies heavily on EV sales, but CEO Elon Musk envisions a future where Tesla shifts to a software-driven business model. The centerpiece of this vision is Full Self-Driving (FSD) technology.

In October, Tesla introduced the CyberCab robotaxi concept, with the ultimate aim of deploying a global fleet of autonomous vehicles. While the potential is vast, significant hurdles remain.

Regulatory and legal challenges around autonomous systems persist, and public sentiment about self-driving technology is still skeptical. According to a 2024 AAA survey, 66% of U.S. drivers reported fears about self-driving vehicles, up from 54% in 2021. Even if Tesla resolves technical issues and gains regulatory approval, public hesitance could hinder widespread adoption.

On a positive note, Elon Musk’s close ties to the anticipated Trump administration might lead to a more favorable regulatory environment, potentially fast-tracking Tesla’s autonomous vehicle ambitions.

The Risks of High Expectations

Tesla has delivered exceptional returns for long-term investors, with its stock gaining 1,430% over the past five years and 1,960% over the last decade. However, such stellar performance has fueled lofty expectations.

The company’s current price-to-earnings (P/E) ratio of 93.1 reflects market optimism that Tesla will not only dominate the EV market but also successfully commercialize FSD technology on a global scale. This optimism has left little room for error, making Tesla stock a high-risk bet at its current valuation.

The Bottom Line

Tesla’s position as a leader in the EV market remains strong, but challenges like slowing growth, rising competition, and public skepticism around autonomous vehicles could weigh on its future prospects. With its valuation already pricing in significant growth, potential investors may find limited upside at today’s prices. For now, caution might be the best approach when considering Tesla stock.